It’s the time of year when I want to check in and see the most recent data on affordable housing in Washington County, so here is a little update.

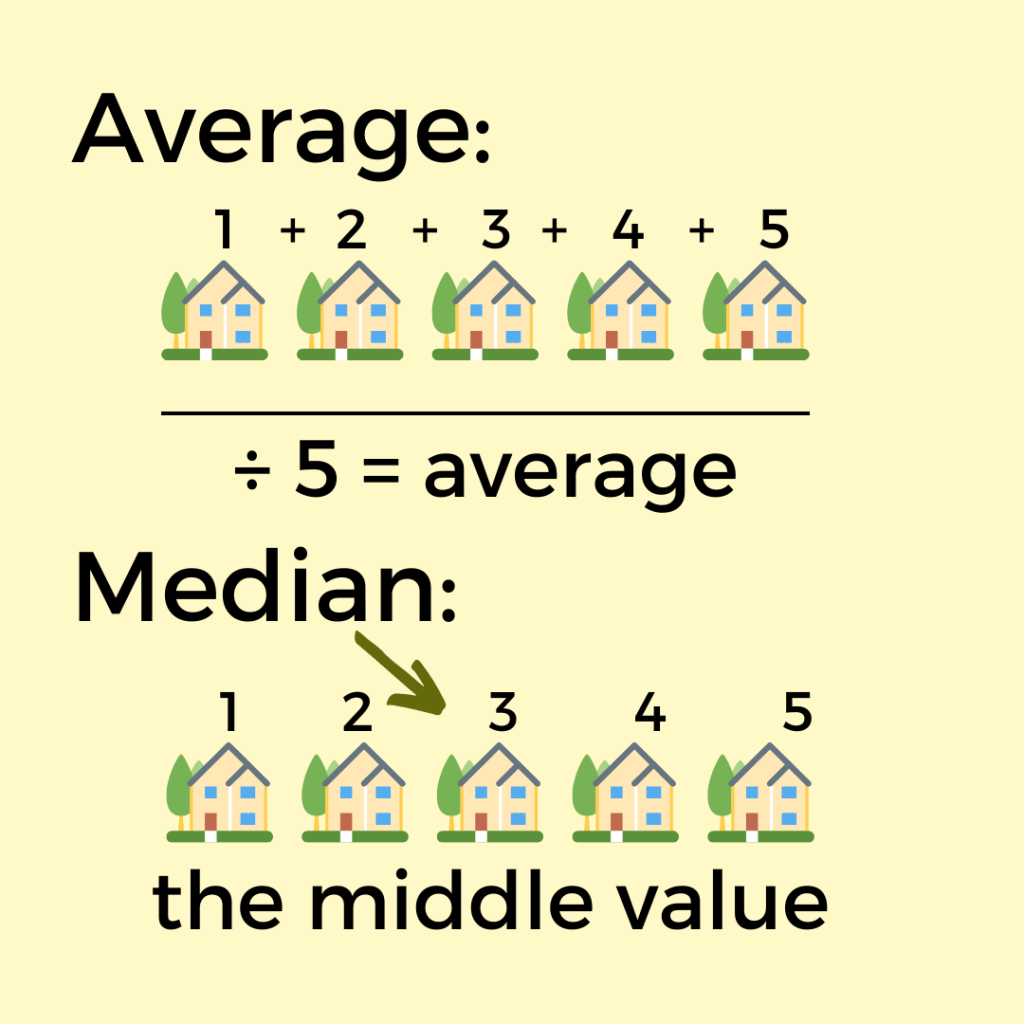

According to the Department of Workforce services, the median income in Washington County, Utah for 2020 was $71,904. The Census said the median income was $76,411 in Washington County in 2023. The median home price was $535,000 for Washington County in September of 2023 according to the Board of Realtors data website. When I ran the numbers in the MLS myself, I got $520K for September of 2024, which tracks with the board’s data showing that the median has come down a little since last year. Knowing all of this, I emailed my friend Scott Stout from Guild Mortgage to ask what kind of income is needed to buy a median home price, and what the median income could buy. This is what he told me:

To buy a $520K home with 7% interest rates and 5% down, a family would need about $102K in income. These numbers also assume low or no car payment, credit cards, student loans, etc.

With the median income of $71K, same assumptions, a buyer could shop for a $375K home. In our current market, that is essentially priced out, or extremely competitive. Many properties at that price point are scooped up by investors as rentals.

As discouraging as some of these numbers are, I see a glimmer of hope in the fact that year over year the median price has come down just a bit. I definitely believe that the drop results from the high interest rates which put downward pressure on prices.