At my office the other day, we were talking about whether a person should look at the median or the average when it comes to home prices and getting a clearer understanding of the market. I remembered back when I had to educate myself about what those two different terms meant. I had learned their definitions in college, but I had forgotten their meanings from disuse. Here is what I learned as I refreshed my memory.

What is an “average” home price?

Finding the average price of a home in an area goes like this. Say you have 101 houses, all at different prices. You put the prices in a spreadsheet, and add the total of all of the prices together, then divide it by 101. That gives you an average price over the whole spread of homes.

What is a “median” home price?

On the other hand, if you want a median price, let’s take those same 101 houses and line them up from the least expensive to the most expensive. The median is the price of house number 51 in the lineup—the very middle house.

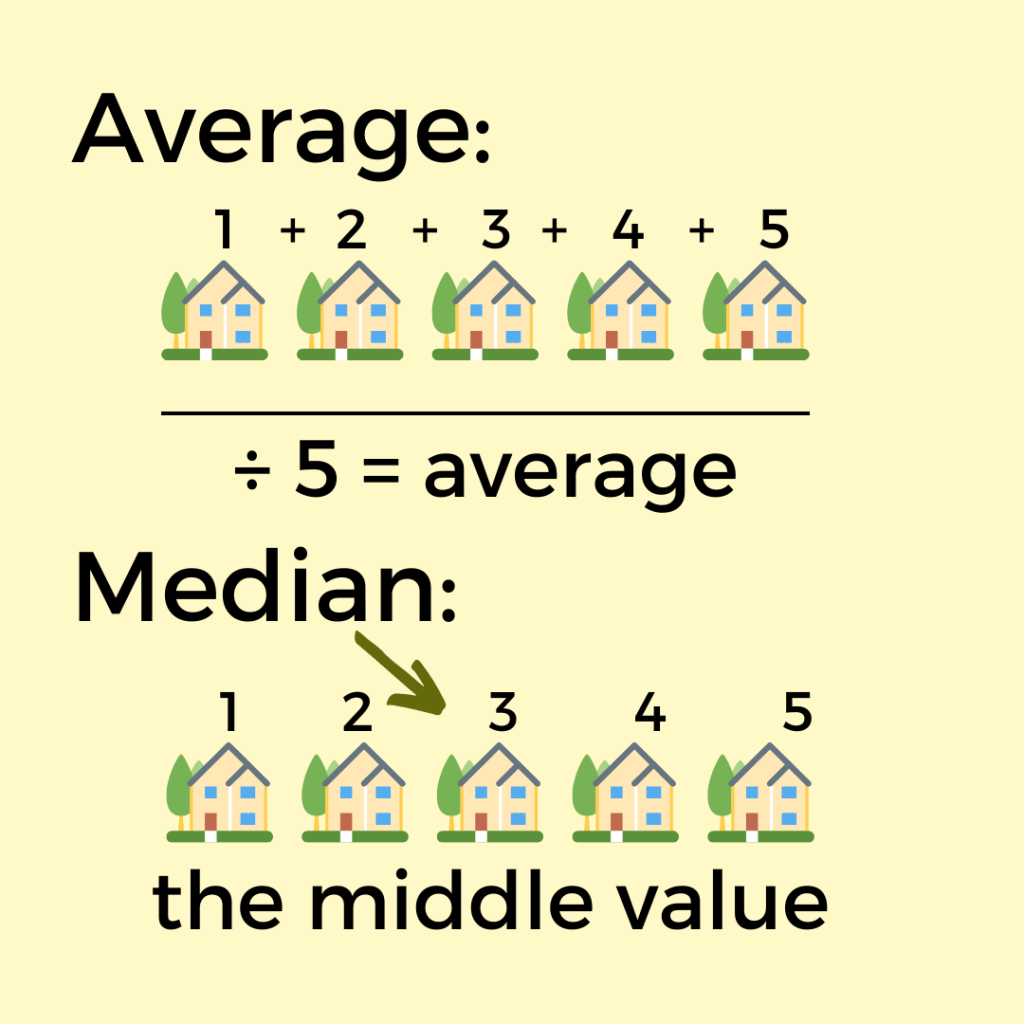

For an even simpler way to view this, look at the image below.

In this image, you can see that if you add 1+2+3+4+5 = 15, and then if you divide it by five (the number of houses you are comparing) you get three. For the median, you just line them up, and the middle one is three. This image is definitely an oversimplification, but hopefully it helps see what each statistical method is doing.

When I look at statistics on housing, I prefer to use the median, and here is why. If there are a 101 people buying a home, I am curious about what is in the middle of that situation. There are equal numbers of homes on both sides of that middle. One thing about the average is that if there are a large number of luxury homes in a market (as with Washington County, Utah) those home prices can pull up the average by virtue of the higher values of the more expensive homes. If we get a big enough number of those expensive properties, we see averages that look much higher than many homes are actually priced.

Occasionally it’s good to watch the average, too, though. For example, in a shifting market we can watch trends. If the average gets closer to the median, that could be a sign of shifting prices from higher to the middle or lower. So which one should you look at first? For me, I usually look at the median. Really, it’s up to you, and hopefully these median v. average notes have helped a little as you decide which to use.